Recurring Deposit

Recurring Deposit :

- All our Deposit Schemes shall be offered to our Members Only.

- The Amaravathi Multi-Purpose Mutually Aided Co-Operative Society Ltd is registered under the Andhra Pradesh Mutually Aided Co-Operative Societies Act – 1995

- All our Deposit Schemes come under Regulated Deposit Schemes Under the Banning of Unregistered Deposits Act-2019.

A Recurring Deposit (RD) account lets member to deposit a fixed installment every month on which they earn a cumulative return (Monthly Compounding) on maturity. The following Variants in RD Accounts are offered by The Amaravathi Multi-Purpose Mutually Aided Co-Operative Society Ltd.

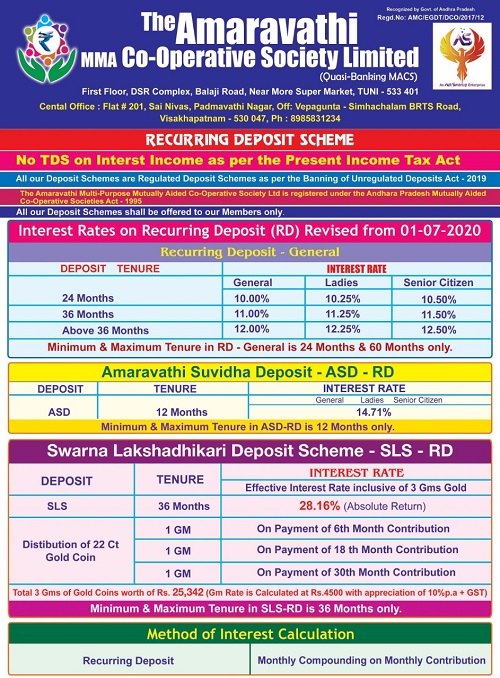

Recurring Deposit –General

There are various tenures of Recurring Deposit –General. It depends on the Customer chosen option, the Interest Rate shall be varies. Once customer chooses the tenure, they cannot change such tenure.

Minimum Recurring Deposit Amount per month is ₹200

Interest Rates of Recurring Deposit General (Quarterly Cumulative)

FAQ’s :

Question : Are there any special benefits in rate of interest for senior citizens and women ?

Answer : Yes, Refer the Table.

Question : Is there any facility for prematurity in Recurring Deposit ?

Answer : Members can premature this deposit as per followings rules :-

(A) For scheme of 12 months duration:

- • Not allowed upto 6 months

- • No interest payable on prematurity payment after 6 months and up to 9 months. Service charge of 2% and stationery charge of Rs. 30/- will be recovered.

- • For pre maturity payment of accounts after 9 months to 12 months, Interest will be paid at the rate of 4% Simple interest and Stationery charge of Rs. 50/- will be recovered.

(B) For scheme of 24 months duration:

- • Up to 12 months: Pre maturity not allowed.

- • After 12 months up to 18 months: Interest rate at the rate of 3% per annum will be paid

- • After 18 months up to 24 months : Interest rate at the rate of 4 % per annum will be paid

(B) For scheme of 36 months duration:

- • Up to 18 months: Pre maturity not allowed.

- • After 18 months up to 18 months: Interest rate at the rate of 2% per annum will be paid

- • After 24 months up to 36 months : Interest rate at the rate of 3% per annum will be paid

Question : Is there any facility for loan in RD ?

Answer : Loan facility is available as per following rules :-

(A) For schemes of 12 months and 24 months duration:

After 6 months (post receipt of 6 installments) : Up to 50% of Deposit amount.

(B) For schemes of above 36 months duration:

After 12 months (post receipt of 12 installments): Up to 60% of Deposit amount.

Interest on such RD loan is +2% on Scheme Interest.

Question : What are the charges if a member skips installments on recurring deposits ?

Answer : Amount of Rs. 1.50 per hundred per month will be recovered if installments are not deposited on regular basis.

Amaravathi Suvidha Deposit – RD

Swarna Lakshadhikari Deposit Scheme-RD